Start Your Journey

Edible Oil Industry: Legal, Licences & Setup Guide

From incorporation to plant, safety and sector-specific licences — here’s a complete, compliance-first roadmap for launching an edible oil business in India.

INTRODUCTION

The edible oil industry in India is a thriving and essential sector, encompassing the production and sale of cooking oils derived from various oilseeds and plant sources. Edible oils such as mustard oil, sunflower oil, groundnut (peanut) oil, coconut oil, soybean oil, sesame oil, rice bran oil, palm oil and many others are staples in Indian kitchens and food industries. India is one of the largest consumers of edible oils globally, with demand driven by its huge population and culinary traditions. Given the importance of edible oils as a food commodity and an essential household item, the industry is regulated to ensure quality, safety and steady supply. Starting a business in the edible oil sector can be lucrative, but it requires meticulous planning and compliance with multiple legal requirements. From choosing the right business structure and incorporating your company to obtaining necessary government approvals and licenses, there are many steps involved. In this comprehensive guide, we will explain everything you need to know to start an edible oil business in India – including business incorporation, key approvals, licenses required by Indian law and practical tips. This article keeps a PAN-India perspective, meaning the information is generally applicable across all states in India, though some local specifics may vary. By the end, you will understand the process and compliance requirements for launching your edible oil venture, whether you plan to produce cold-pressed oils on a small scale or set up a large refining unit.

TYPE OF BUSINESS SUITABLE FOR THE EDIBLE OIL INDUSTRY

One of the first steps in establishing your edible oil business is deciding the appropriate business structure. In India, you have several options for business forms, each with its pros and cons. Common structures include:

- Sole Proprietorship: A single-person business that is simple to start and has minimal formalities. This may suit a very small-scale oil business or trading operation. However, the proprietor has unlimited personal liability and it can be harder to obtain bank loans or attract investors under this structure.

- Partnership Firm: If you have one or more partners, a partnership allows shared investment and responsibilities. It is relatively easy to form via a partnership deed, but like proprietorship, partners have unlimited liability (unless registered as an LLP) and disputes can arise without clear agreements.

- Limited Liability Partnership: An LLP provides partners with limited liability protection while allowing a flexible partnership management structure. This can be a good middle-ground for a family-run or medium-scale oil mill, offering credibility and legal recognition.

- Private Limited Company: Best for growth-driven edible oil ventures, a private company offers limited liability, separate legal identity and easier access to funding. It builds trust with large buyers and regulators. Though compliance is higher, it’s suitable for manufacturing units or refineries requiring large investments and future scalability.

Why is a Private Limited Company often recommended? A Private Limited Company is often recommended because it limits promoter liability, protects personal assets and provides easier access to funding from banks or investors. For capital-intensive sectors like edible oil—where machinery, factory setup and distribution contracts are involved—a company structure ensures formal compliance and credibility. However, if you're starting small (e.g., a cold-pressed unit), you may begin as a proprietorship or partnership and upgrade later. Your choice should depend on scale, ownership, investment and risk. Consulting a legal expert helps align structure with long-term goals. Once chosen, the business must be formally registered with all necessary approvals.

NECESSARY APPROVALS FOR STARTING AN EDIBLE OIL BUSINESS

Starting an edible oil business in India involves obtaining several approvals and clearances from various authorities even before you commence operations. These approvals ensure that your business is set up in adherence to local zoning laws, environmental regulations and safety standards. Below, we outline the key approvals required:

- Business Incorporation Approval: Register your entity (Private Limited, LLP, proprietorship or partnership) with the MCA or relevant authority to obtain a Certificate of Incorporation. This gives your business legal identity and is a prerequisite before applying for any further licenses or approvals necessary to operate legally.

- Location and Land Use Permission: For manufacturing units, obtain land-use conversion (if applicable) and building plan approval from local authorities. These ensure your plant complies with zoning laws, structural safety and industrial regulations. Operating without these permissions can result in legal issues or closure of your facility.

- Environmental Consent (Pollution Control Board NOCs): Get Consent to Establish (CTE) and Consent to Operate (CTO) from the State Pollution Control Board. These NOCs ensure compliance with environmental laws like the Water and Air Acts. Without them, operations are illegal and can lead to heavy penalties or shutdown orders.

- Fire Department NOC: Obtain a Fire NOC by meeting fire safety standards, including alarms, hydrants and emergency exits. The fire department inspects the premises before issuing the certificate. This is mandatory for factory licensing and ensures the facility is legally compliant and safe for workers and equipment.

- Electricity Connection and Boiler Inspection (if applicable): Apply for an industrial electricity connection with proper sanctioned load. If using boilers, get inspection and certification from the Boiler Inspectorate as per the Boiler Act. These approvals are vital to ensure operational readiness and safety before starting production activities.

REQUIRED LICENSES FOR THE EDIBLE OIL BUSINESS

Once the initial approvals and setup formalities are in place, you must obtain various licenses and registrations to legally operate and sell your edible oil products. Below is a list of the key licenses/registrations required, each explained in a few sentences:

- FSSAI Food Business License: Mandatory for all edible oil businesses. Obtain Basic, State or Central FSSAI license based on scale. The 14-digit license ensures your oil is safe and traceable. Display it on all packaging. No license means penalties or shutdown.

- Registration under the Edible Oils Packaging/Essential Commodities Regulations: Manufacturers must register with the Directorate of Sugar & Vegetable Oils. Monthly production and stock reporting is mandatory under the 2025 amendment. This prevents hoarding and ensures government monitoring of essential edible oils.

- GST Registration: Required if turnover exceeds threshold (₹20–₹40 lakh). Most edible oil businesses register for GST to sell legally, issue invoices and claim input tax credit. Regular GST returns must be filed to avoid penalties.

- Factory License: Needed if your unit employs 10+ workers (with power) or 20+ (without). Obtained from the state’s Factory Inspectorate after fire/building approvals. Ensures worker safety and legalizes factory operations.

- Trade License from Local Authority: Issued by local municipalities, this license allows you to run a commercial business from a specific premise. Ensures your unit complies with local rules and does not cause nuisance or safety hazards.

- MSME/Udyam Registration: Optional but beneficial. Helps small edible oil businesses access government schemes, subsidies and loans. Register online to classify your business as micro, small or medium enterprise for added financial and operational advantages.

- AGMARK Certification (Quality Certification): Mandatory for blended edible oils; optional but beneficial for others. AGMARK certifies product purity and quality. Involves testing and compliance with DMI norms. Enhances consumer trust and is often required for retail.

- BIS Certification (Indian Standards): Voluntary for most edible oils. Required only for select products like Vanaspati or when exporting to specific markets. BIS certifies compliance with Indian Standards and improves credibility in premium or export segments.

- Import-Export Code (IEC): Mandatory for importing oil/raw materials or exporting edible oil products. Issued by DGFT, this 10-digit code is required for all international trade transactions involving customs clearance.

WHY APPROVALS AND LICENSES ARE NEEDED

It is natural to wonder why so many approvals and licenses are necessary to start an edible oil business. While the process may feel cumbersome, each requirement serves an important purpose in safeguarding your business, consumers and the public interest:

- Legal Compliance and Avoiding Penalties: Licenses are legally mandatory. Operating without them (like FSSAI or environmental clearance) can lead to fines, shutdowns or jail. Staying compliant protects your business from raids and legal trouble. It’s smarter—and safer—to follow the law from the start than to risk costly penalties later.

- Food Safety and Consumer Health: Licenses like FSSAI ensure your edible oil is hygienic, unadulterated and properly labeled. Compliance protects public health and builds consumer trust. It also improves product quality and reduces risk of reputational damage from food safety issues—key to maintaining a responsible and reliable brand.

- Quality and Market Acceptance: Certifications like AGMARK or BIS enhance your brand’s credibility and appeal. Many distributors and quality-conscious buyers prefer certified oils. These marks help your product stand out, especially in premium segments, proving that you meet high purity and safety standards despite being a new entrant.

- Environmental and Safety Responsibility: Pollution Control and Fire NOCs ensure your plant is eco-friendly and safe. These approvals enforce installation of safety systems and pollution controls. They prevent disasters, protect communities and reduce liability—making your operations sustainable and legally protected against environmental or fire-related incidents.

- Supply Chain and Regulatory Oversight: Government-mandated registrations like VOPPA enable edible oil supply transparency. Regular reporting helps prevent hoarding, stabilize prices and ensure fair market competition. Though administrative, this oversight fosters industry stability, protecting both consumers and your business from unpredictable policy crackdowns due to non-compliance.

In summary, each approval or license exists for a reason – be it protecting public health, ensuring worker safety, safeguarding the environment or maintaining fair trade. They legitimize your business in the eyes of law and customers. Moreover, having all proper certifications can be a selling point: for example, you can proudly advertise that your manufacturing unit is FSSAI licensed, ISO-following, Agmark certified, etc., which many clients interpret as “this business is professional and trustworthy.” It might feel like a lot of bureaucracy, but by going through these steps diligently, you are essentially bullet-proofing your business against legal challenges and setting a strong foundation for long-term success.

HOW LAWFNITY CAN HELP YOU ESTABLISH YOUR EDIBLE OIL BUSINESS

Setting up an edible oil business involves juggling many tasks – from legal paperwork to technical setup – and it can be overwhelming for entrepreneurs. This is where Lawfinity comes into the picture as your dedicated business setup partner. We at Lawfinity specialize in helping businesses navigate the legal and regulatory maze with ease. If you’re wondering how exactly we can assist, here’s how:

- End-to-End Business Incorporation: Lawfinity helps choose the right structure (Private Limited, LLP, etc.) and handles complete incorporation – from name approval to PAN, TAN and Certificate of Incorporation. We ensure quick, error-free setup so your edible oil business is legally ready to operate without delay.

- Obtaining Necessary Licenses and Approvals: We handle FSSAI, Pollution NOC, Fire NOC and VOPPA registration—preparing documents, coordinating inspections and liaising with departments. Our expertise saves you from procedural hassles and ensures you get all mandatory approvals efficiently and in full legal compliance.

- Advisory on Compliance and Documentation: Lawfinity provides ongoing support—license renewals, annual filings, GST, ESI/PF registration and audit readiness. We help you maintain records like lab reports or pollution logs, ensuring your edible oil unit stays compliant while you focus on operations and business growth.

- Custom Solutions and Expert Network: We connect you with experts for FSMS, ISO 22000 and trademark registration. From reviewing lease deeds to drafting contracts, Lawfinity offers holistic legal support tailored to your edible oil venture’s needs, helping build a strong and protected business foundation.

- Smooth and Time-Bound Process: With Lawfinity’s experience, you avoid delays and mistakes. We streamline every legal step—incorporation, approvals and compliance—keeping you informed throughout. Our goal is to get your oil business legally launched quickly, smoothly and stress-free.

Lawfinity is your one-stop legal partner for starting and running an edible oil business in India… With Lawfinity, your business starts right—legally strong, stress-free and ready to thrive.

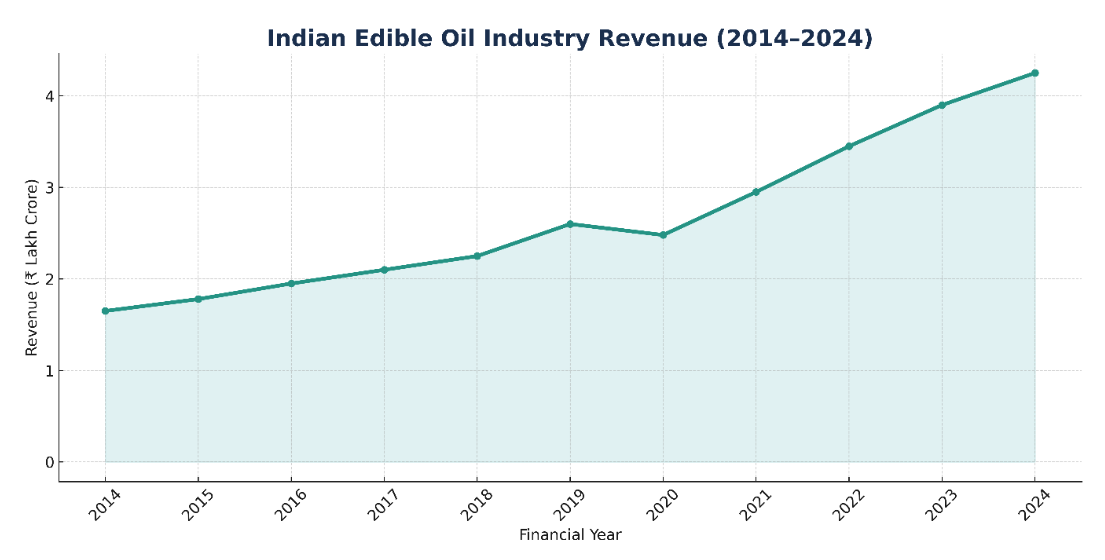

INDIAN EDIBLE OIL INDUSTRY REVENUE (2014–2024)

Source: (SEA of India (Solvent Extractors’ Association), Ministry of Agriculture & Farmers Welfare, Statista, IBEF and Business Standard market insights

AUTHOR’S OPINION: FROM STAPLE TO STRATEGIC COMMODITY

The Past: Steady Demand Meets Import Dependency (2014–2020)

From FY 2014–15 to FY 2019–20, India’s edible oil market grew at a moderate pace, moving from ₹1.65 lakh crore to ₹2.60 lakh crore. This growth was largely fueled by population increase, evolving cooking preferences and higher per capita oil consumption. However, a major challenge during this period was India’s overwhelming dependence on imports — nearly 65% of the edible oil requirement was being met by importing palm, soybean and sunflower oil.

Domestic production of oilseeds struggled due to low yields, fragmented land holdings and limited processing infrastructure. Despite these limitations, demand continued to rise — making the sector a silent but significant contributor to India’s FMCG and agri-processing economy.

The Present: COVID Wake-Up & Domestic Push (2020–2024)

The COVID-19 pandemic disrupted global logistics and highlighted India’s vulnerability to price volatility and supply chains. Edible oil prices surged, exposing the risk of heavy import reliance. This became a wake-up call for policymakers and the industry alike.

From FY 2020–21 onwards, government schemes like the National Mission on Edible Oils – Oil Palm (NMEO-OP) were introduced to boost domestic cultivation. Consumer behavior also changed — with a strong shift toward packaged oils and branded products, improving hygiene and quality perceptions. As a result, the market bounced back rapidly, growing from ₹2.48 lakh crore in FY 2020–21 to ₹4.25 lakh crore in FY 2023–24.

The Future: Self-Reliance and Sustainable Growth (2024 Onwards)

Looking forward, the edible oil industry is poised for transformation. With initiatives to double domestic oilseed production, encourage sustainable palm plantations and reduce import dependency to under 50%, the future looks promising.

Key growth drivers include:

The industry is projected to grow at a CAGR of 8–9% over the next five years, potentially crossing ₹5.5–₹6 lakh crore by FY 2027–28, depending on geopolitical stability and policy continuity.

CONCLUSION: FROM COMMODITY TO NATIONAL PRIORITY

From my perspective, the Indian edible oil sector has evolved from being a passive food commodity to a strategic pillar of food security and economic planning. Its journey from ₹1.65 lakh crore to ₹4.25 lakh crore has been driven by consumer evolution, market reforms and urgent self-reliance needs.

What was once a background industry is now at the center of India’s agri-industrial transformation. The next decade isn’t just about refining oil — it’s about refining policy, capacity and consumer trust.

The edible oil industry is no longer just a kitchen essential — it’s India’s nutrition frontier and a self-reliance battleground.

Frequently Asked Questions

Because every great business starts with the right answers.

You’ll need FSSAI license, Pollution Control Board NOC, Fire NOC, GST registration, Factory License (if manufacturing), business incorporation and possibly AGMARK and VOPPA registration, depending on operations.

Yes, FSSAI license is mandatory for any edible oil business, regardless of scale. It ensures your product meets safety standards; operating without it invites legal penalties and shutdowns.

Private Limited Company is preferred for growth and funding. Startups may begin as proprietorships or partnerships, but scaling up requires limited liability and credibility, best provided by a company or LLP.

Yes, you need Consent to Establish and Operate from the Pollution Control Board. Apply with project details, install required controls and undergo inspection before receiving the NOC.

Investment ranges from ₹5–15 lakhs for small mills to ₹5 crores+ for large refineries. Budget for machinery, land, licenses and working capital. Start small, then expand.

Yes, schemes like PM FME, state subsidies and MSME benefits (like CGTMSE) offer support. Check with local DICs and MoFPI for applicable grants, subsidies or incentives.

Comply with FSSAI standards for oil purity, fortification and packaging rules. AGMARK adds credibility. Regular lab testing and proper labelling ensure compliance and consumer trust.

Trademark registration is highly recommended to protect your brand. Apply under Class 29. It gives legal protection and exclusivity, guarding against lookalike brands or copycats.

It can take 3–6 months, depending on scale and approvals. Incorporation, FSSAI, GST, Pollution NOC, Fire NOC and Factory License timelines vary. Start early for smooth setup.