Start Your Journey

Import-Export Industry: Start, Comply & Scale with Confidence

Everything required to start an import-export business in India — business incorporation, necessary government approvals, licenses as per Indian law, practical advice and FAQs.

INTRODUCTION

India’s growing presence in the global marketplace has made the import-export industry an attractive venture for entrepreneurs. By facilitating exchange of goods across borders, this sector drives economic growth, creates jobs and fosters innovation. However, to launch an import-export business, one must understand and fulfill all legal requirements – from choosing the right business structure and registering the company to obtaining mandatory licenses and approvals. This guide explains everything required to start an import-export business in India, covering business incorporation, necessary government approvals, licenses as per Indian law and practical advice. We will also address common FAQs and share expert tips to help you embark on your global trading journey with confidence.

TYPE OF BUSINESS SUITABLE FOR IMPORT-EXPORT

Choosing the right business structure is a crucial first step. In India, you can operate as a sole proprietorship, partnership, Limited Liability Partnership (LLP), private limited company, One Person Company (OPC), etc. Each has its pros and cons for an import-export venture:

- Sole Proprietorship: A business owned and run by one person. It is easy and cheap to start with minimal formalities. However, the owner has unlimited personal liability, meaning personal assets are at risk. It is best for small traders but limits growth and credibility with banks and larger suppliers.

- Partnership Firm: Formed by two or more people through a partnership deed. It’s easy to set up, but all partners have unlimited liability. Often avoided for larger or international business due to risks of disputes and liability. Registration is optional, but LLP or company is usually better for growth.

- Limited Liability Partnership (LLP): An LLP offers limited liability and a separate legal identity. It requires MCA registration. Partners aren’t personally liable for business debts. It’s suitable for growing export businesses, offering flexibility, credibility and lower compliance than companies. Ideal for founders who want formal structure without full corporate obligations.

- Private Limited Company: A registered company under the Companies Act, offering limited liability and separate legal status. Though it involves higher compliance, it ensures strong credibility with banks and buyers. Preferred for larger import-export businesses, as it allows easy funding, structured growth and better reputation with domestic and international stakeholders.

- One Person Company (OPC): A private company with a single shareholder. It gives limited liability and separate legal status to solo entrepreneurs. Best for small-scale exports or startups, though conversion to a private limited company is needed once certain revenue or ownership limits are crossed. Offers professionalism without requiring multiple owners.

Which structure is best? While you can start as a sole proprietor or partnership (and indeed many small export businesses do), a Private Limited Company (or an LLP) is generally best suited for serious import-export ventures. It provides credibility, easier access to financing and legal safeguards.

A company structure reassures foreign clients and government bodies that your business is well-structured and compliant. Moreover, having a separate legal entity ensures your personal assets are protected from business liabilities – a critical factor given the financial risks in global trade. In summary, if you plan to scale up or deal with international partners, opting for a private limited company is highly recommended for import-export business success.

NECESSARY APPROVALS AND REGISTRATIONS

Before you can start trading internationally, several approvals and registrations must be in place to make your business legally operational. These ensure your enterprise is recognized by government authorities and compliant with regulations:

- Business Incorporation (Company/LLP Registration): Register your business legally as a proprietorship, partnership, LLP or company. This gives you a formal legal identity, allowing you to apply for import-export licenses like IEC. It’s the first step to begin foreign trade in India.

- Tax Registrations (PAN and GST): Get a PAN from the Income Tax Department and register for GST. PAN is essential for all financial transactions. GST helps in claiming input credits and is practically mandatory for import-export businesses dealing with cross-border goods.

- Bank Account (Authorized Dealer) and Foreign Exchange Setup: Open a current account with an Authorized Dealer bank. Register the AD Code with Customs to enable foreign currency transactions. This account handles export-import payments and is necessary for customs clearance and government benefits like duty refunds.

- Import-Export Code (IEC) from DGFT: Obtain an IEC from DGFT to legally import or export goods. Though linked to PAN now, formal registration is still required. It’s a lifetime-valid unique code used in customs filings, international trade documentation and foreign exchange transactions.

- Other Regulatory Approvals (if applicable): Depending on your sector, approvals like Factory License, Pollution NOC or commodity board registrations may be required. These are necessary for manufacturing, export of regulated items or when foreign investment is involved. Check industry-specific compliance requirements in advance

By completing the necessary registrations and approvals, you essentially make your business fully legitimate in the eyes of Indian law. These approvals are about setting up the basic legal infrastructure of your enterprise. Once these are in hand, you can move on to obtaining specific licenses and permits needed for your import-export operations.

REQUIRED LICENSES FOR IMPORT-EXPORT BUSINESS

In addition to the general approvals above, you must secure certain key licenses to legally engage in international trade. These licenses and registrations are specific permissions or memberships that allow you to import/export particular goods or access trade benefits. Below are the essential licenses usually required:

- Importer-Exporter Code (IEC): Issued by DGFT, the IEC is mandatory for all import-export activities. It is a one-time, PAN-linked license used in customs, shipping and forex dealings. Without it, no international trade transactions can be legally conducted in India.

- GST Registration Certificate: A GSTIN is needed to import/export goods and claim tax refunds. It is essential for customs clearance and tax compliance. Exports are zero-rated, so GST registration helps in availing exemptions or refunds, making it vital for most trading businesses.

- Trade License / Shop & Establishment Registration: Required for operating physical offices, shops or warehouses. Issued by municipal or labour departments, it ensures legal business operations and compliance with labour laws. Though not trade-specific, it is necessary for any business with premises or employees in India.

- Product-Specific Licenses/Permits: Depending on the nature of goods you plan to trade, you may need additional licenses or permits from relevant authorities:

- If dealing in food or agro products: FSSAI license ensures food safety compliance. Exporters of scheduled agro products must register with APEDA to access export benefits and meet mandatory norms for certain food categories.

- If dealing in pharmaceuticals, medical devices or cosmetics: Exporting/importing drugs or medical items needs drug licenses from CDSCO or state FDA under the Drugs and Cosmetics Act. Specific product-wise import approvals are mandatory for legal trade.

- Electronics and Telecommunication equipment: Items like wireless devices need WPC approvals. Many electronics must meet BIS certification standards. Importers must ensure BIS compliance or obtain required certifications for regulated tech products.

- Chemicals and hazardous materials: Imports of industrial chemicals may need permissions from departments like the PESO (Petroleum & Explosives Safety Organization) if they are explosive or hazardous. For ozone-depleting substances or hazardous wastes, clearances from environmental authorities are required.

- Restricted/Controlled items: Items listed as “restricted” (e.g., seeds, defense gear, antiques) require import/export licenses or NOCs from DGFT or respective ministries. Check product-specific policy to avoid illegal shipments.

In summary, aside from the universal IEC, check the regulations for your specific product line. You may need to secure additional licenses or certificates to comply with sector-specific laws. It is wise to consult a legal expert or refer to the Foreign Trade Policy and customs notifications to identify any special license requirements for your goods.

- Registration cum Membership Certificate (RCMC): RCMC is issued by an Export Promotion Council linked to your product type. It is essential to claim government export benefits and participate in trade programs. Though not mandatory initially, it’s highly recommended once you start exporting.

- Logistics and Customs Compliance: Register on ICEGATE for online customs filings using a Class III DSC. Hire or become a licensed CHA for clearance processes. Also, get Marine Cargo Insurance to protect goods during transit—these steps ensure smooth and secure trade operations.

Each required license has its own application process and documentation. The Importer-Exporter Code is the first and foremost license – without it, you cannot move forward. Product-specific licenses ensure you comply with health, safety and quality regulations for those goods. Trade and local licenses keep your domestic operations lawful. And memberships like RCMC integrate you into the export ecosystem for benefits. Obtaining all necessary licenses might seem daunting, but once acquired, they allow you to trade confidently, knowing you are on the right side of the law.

WHY APPROVALS AND LICENSES ARE NEEDED

You might wonder, why go through the hassle of all these approvals and licenses – can’t one just start trading? In India (as in any country), government approvals and licenses are compulsory to regulate business activities and ensure accountability. Here’s why they are needed and important:

- Legal Compliance and Avoiding Penalties: Operating without required licenses like IEC or GST is illegal and can lead to fines, shipment seizures or business bans. Proper registration ensures your business follows Indian law and avoids harsh penalties or disruptions.

- Regulating Quality and Safety: Licenses like FSSAI or drug approvals ensure only safe, high-quality products are traded. They protect consumers, enforce standards and maintain India’s global trade reputation by preventing unqualified businesses from dealing in sensitive or regulated goods.

- Monitoring and National Security: Licenses help the government track goods, collect revenue and control restricted items like defence equipment. They ensure trade transparency, protect national interests and support enforcement of trade, security and environmental regulations across international borders.

- Financial and Tax Benefits: Proper registrations enable exporters to claim GST refunds, duty drawbacks and access incentive schemes. Without them, you lose money and face banking restrictions. Licenses also help in smooth foreign currency transactions under RBI regulations.

- Credibility and Business Growth: Being fully registered builds trust with global buyers and suppliers. It shows professionalism and legal compliance, essential for partnerships and scaling operations. Licensed businesses also avoid sudden legal issues, supporting steady, long-term growth.

In summary, these approvals and licenses are needed not just because the law demands them, but because they enable you to operate smoothly, safely and profitably. They level the playing field by ensuring every player meets minimum standards. Skipping any required license is not an option – it’s like trying to drive without a valid driver’s license; you are exposing yourself to enormous risk. So, embrace the compliance process as an integral part of doing business in the import-export industry.

HOW LAWFINITY CAN HELP YOU ESTABLISH YOUR BUSINESS

Setting up an import-export business involves dealing with multiple government departments, forms and regulations – which can be overwhelming. This is where Lawfinity comes in as your trusted partner. Lawfinity.in is a team of legal and business experts specialized in helping entrepreneurs start and manage businesses in India. Here’s how Lawfinity can assist in establishing your import-export venture:

- Expert Business Incorporation Services: Lawfinity helps choose the ideal business structure and handles complete incorporation, including DSC, DIN, PAN and TAN. We ensure your business is legally registered with all documentation, providing a strong foundation from the very start.

- Licenses and Approvals Made Easy: We simplify obtaining IEC, GST and sector-specific licenses by handling filings, document preparation and authority coordination. Lawfinity ensures fast approvals and links everything—from customs facilitation to special licenses—so you avoid delays and bureaucratic hassles.

- Compliance and Documentation Support: Lawfinity offers post-setup compliance support including GST returns, customs documentation, RCMC registration and duty drawback claims. We ensure ongoing legal and procedural compliance, so you stay eligible for incentives and avoid regulatory issues.

- Advisory and Legal Support: We guide you through trade laws, customs duties, BIS norms, contracts and RBI/FEMA rules. Lawfinity also represents you in legal issues like customs disputes or DGFT clarifications, ensuring you avoid costly errors in import-export operations.

- End-to-End Handholding: From incorporation to your first shipment, Lawfinity provides complete, customized support. We manage all legal and procedural aspects, letting you focus on business growth while we ensure everything runs smoothly behind the scenes.

In short, Lawfinity acts as your backstage support team to launch your business successfully. With our deep knowledge of Indian business laws and import-export regulations, we streamline the setup process and save you time, effort and potential frustration. We are committed to turning the complex process of starting an import-export venture into a smooth experience for you. With Lawfinity’s help, you can confidently step into the world of global trade, knowing that all the legalities are handled and your business is built on solid ground.

(Reach out to Lawfinity.in to discuss your specific needs – we’re here to help your import-export dream take flight!)

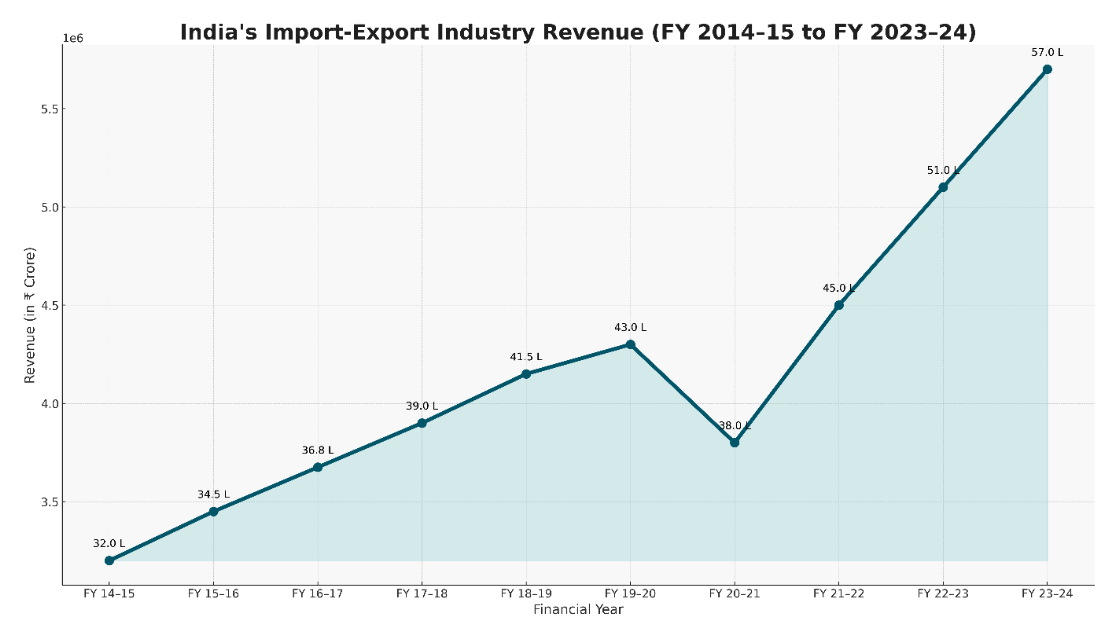

INDIAN IMPORT-EXPORT INDUSTRY REVENUE (2014–2024)

Source: Source: Reserve Bank of India (RBI) Annual Reports, Ministry of Commerce & Industry, World Trade Organization (WTO) and UNCTAD and Government of India Economic Surveys and Budget Documents

AUTHOR’S OPINION: TRADE’S RISE, SHOCK & RESILIENCE

The Past: Steady Expansion (FY 2014–15 to FY 2019–20)

Between FY 2014–15 and FY 2019–20, India’s import-export revenue grew from ₹32 lakh crore to ₹43 lakh crore, reflecting a phase of measured, policy-backed expansion. Merchandise exports such as textiles, pharmaceuticals, refined petroleum, engineering goods and automobiles formed the bulk of outbound trade. On the import side, India’s rising demand for crude oil, electronics and machinery fuelled steady volumes.

At the same time, services exports—notably IT, healthcare, tourism and business process outsourcing—began to contribute significantly to the total export basket. Government interventions like Foreign Trade Policy 2015–20, simplification of export procedures and digital port logistics ensured that India maintained stable momentum in the global trade arena. While India wasn’t yet at the front of the global export league, it was clearly building capacity and credibility.

The Present: COVID Shock and Rapid Rebound (FY 2020–21 to FY 2023–24)

FY 2020–21 was a watershed year, with global lockdowns, container shortages and falling international demand reducing India’s trade revenue to ₹38 lakh crore. The decline affected nearly all sectors—from automotive to garments, from software to tourism. Factories halted, ports idled and supply chains stretched thin across the world.

Yet, India’s trade recovery was quicker than expected. By FY 2021–22, total trade jumped to ₹45 lakh crore, reaching ₹51 lakh crore in FY 2022–23 and further to ₹57 lakh crore in FY 2023–24. What led this resurgence? Multiple factors played a role:

- Resilience in pharmaceuticals and agri-exports

- Digitisation of export clearances through ICEGATE & DGFT portal

- Strong global demand for IT-enabled services and fintech solutions

- India emerging as an alternative supply chain hub to China for select goods

Unlike earlier periods, this phase marked a transition from volume-based trade to value-based, tech-driven exports. Exporters learned fast, diversified their markets and adopted automation.

The Future: Trade as an Engine of Inclusive Growth (FY 2024–2030)

Looking ahead, India’s import-export sector is expected to expand at a CAGR of 8–10%, reaching beyond ₹75–80 lakh crore by FY 2028–29, according to projections from the Ministry of Commerce and EXIM institutions. Growth in the next phase will not be just quantitative—it will be strategic and diversified.

Key drivers include:

- PLI (Production Linked Incentive) Schemes across electronics, green tech, textiles and semiconductors

- Bilateral trade agreements (like with UAE, Australia and UK in progress)

- Free Trade Zones and coastal economic clusters enhancing logistics competitiveness

- Digitisation of cross-border payments, trade finance and customs clearance

- Integration with global value chains (GVCs) for semiconductors, renewable energy, health-tech and AI services

Services trade—especially in digital health, financial analytics and remote education—is expected to be a silent multiplier. Moreover, India’s diplomatic efforts in the Global South, along with stronger participation in WTO, BRICS and G20, signal that trade will be a core pillar of India’s external policy.

CONCLUSION: TRADE IS INDIA’S ECONOMIC PLAYBOOK

From my perspective, India’s import-export sector has undergone a fundamental repositioning—from being a peripheral economic activity to becoming a strategic lever for growth and global influence. The graph tells a clear story: despite facing one of the worst global disruptions in a century, India's trade rebounded and grew stronger.

This isn’t just about customs data or port volumes anymore.

Trade now reflects:

- India’s manufacturing reforms

- Policy maturity

- MSME integration

- Digital governance

For entrepreneurs, exporters, policy thinkers and global investors, the message is clear: India’s trade is no longer reactive—it’s proactive, resilient and intentional.

In the coming decade, India will not just participate in global trade—it will shape it.

Frequently Asked Questions

Because every great business starts with the right answers.

Set up a legal business, get PAN, open a bank account, obtain IEC, GST registration and product-specific licenses if required to begin import-export operations.

You can start as a sole proprietor. For scalability, credibility and liability protection, a Private Limited Company or LLP is recommended as your business grows.

IEC is a 10-digit DGFT code needed for import/export. Apply online with PAN, bank details and documents. It’s mandatory and valid for life.

Yes, goods like food, medicine, electronics need licenses like FSSAI, CDSCO, BIS. Check ITC-HS code or consult experts to confirm product-specific requirements.

Yes. GST is needed to claim IGST refund, file LUT and comply with tax laws. It’s mandatory once thresholds or interstate supplies are involved.

Startup costs vary; you can begin with ₹50K–₹1.5L. Higher capital is needed for inventory, customs or manufacturing. Start small and scale gradually.

Imports incur BCD, IGST and other duties. Exports are mostly tax-free. GST refunds and duty drawbacks are available for registered exporters with proper filings.

Setup takes 2–3 weeks for company, IEC and GST. Product-specific licenses like FSSAI may take longer. Full readiness is possible within a month.

Yes, schemes like RoDTEP, Duty Drawback, EPCG and interest subsidies exist. Join an EPC and register properly to claim export incentives and tax benefits.