Start Your Journey

Insurance Industry: Legal, Licences & Setup Guide

From incorporation to IRDAI approvals and sector-specific licences — here’s a complete, compliance-first roadmap for launching an insurance business in India.

INTRODUCTION

The insurance industry in India is rapidly expanding, projected to reach USD 222 billion by 2026, positioning India as the sixth-largest insurance market globally. With increasing awareness of financial protection and risk management, the sector offers strong opportunities for entrepreneurs and investors. However, due to its sensitive nature, the insurance business is tightly regulated—entities must obtain registration from the Insurance Regulatory and Development Authority of India (IRDAI) before starting operations.

This guide provides a structured overview of how to launch an insurance business in India. It covers choosing the right business structure, registering your company, obtaining IRDAI approval and securing the mandatory licenses. It also outlines different types of insurance ventures you can explore and explains why regulatory compliance is critical. With Lawfinity’s expert assistance, you can confidently navigate these legal complexities and set up a fully compliant insurance business in India.

TYPE OF BUSINESS SUITABLE FOR THE INSURANCE INDUSTRY

One of the first decisions you must make is choosing the type of business entity and model for your insurance venture. Unlike some small businesses which can operate as sole proprietorships, the insurance sector has specific requirements on the form of organization. Here’s a look at the suitable business types and our advice on what works best:

- Insurance Company (Insurer): To start an insurance company (life, general or health), you must register as a company under the Companies Act—typically as a public limited company. This structure meets regulatory norms, enables capital raising and ensures greater transparency. The Insurance Act, 1938 strictly prohibits unregistered entities from offering insurance. Hence, forming a public company is mandatory for insurers, especially considering the high capital requirements and the need to gain trust from regulators and stakeholders.

- Insurance Intermediary (Broker/Agent/etc.): If launching a full insurance company feels overwhelming, consider becoming an insurance intermediary—such as a broker, agent, web aggregator or marketing firm. These ventures often incorporate as private limited companies or LLPs, offering credibility, limited liability and simpler compliance. While individual agents may operate as sole proprietors, scaling operations is easier through a company or LLP. All insurance entities must solely focus on insurance activities—mixing unrelated businesses in the same entity is not permitted.

- Choosing the Right Model – Insurer vs Intermediary: Choosing your insurance business model is key—you can either become an insurer (underwriting policies and assuming risk) or an intermediary (like a broker or agent selling policies for existing insurers). Insurers face high entry barriers, including ₹100 crore capital and lengthy IRDAI approvals, while intermediaries need lower capital (starting ₹75 lakhs) and face a quicker process. For most entrepreneurs, starting as an intermediary is more practical. Regardless of the model, you must incorporate a compliant company or LLP vetted by IRDAI.

NECESSARY APPROVALS

Starting an insurance industry business in India involves obtaining several regulatory approvals at different stages. These approvals ensure that only serious and qualified players enter the market. Below, we outline the necessary approvals you will need:

- IRDAI Name Approval (NOC for Using “Insurance” in Name): Before incorporation, you must get a No-Objection Certificate (NOC) from IRDAI to use terms like “Insurance” or “Assurance” in your company name. Submit a proposal detailing your intent, promoters and business plan. The NOC is valid for 6 months, extendable by 3 months.

- In-Principle Approval (Requisition for Registration): Post-incorporation, file Form IRDAI/R1 for in-principle approval to apply for an insurance license. Submit company details, financial projections, promoter backgrounds and plans for rural/social sectors. IRDAI evaluates financial strength and compliance readiness before granting R1 approval or requesting clarifications.

- Final License Approval – Form IRDAI/R2 (Certificate of Registration Application):After R1, apply for the Certificate of Registration via Form IRDAI/R2. Submit proof of capital infusion (₹100 crore minimum), shareholding details, affidavits, FDI compliance (if any) and key agreements. IRDAI reviews infrastructure and preparedness before granting the final license to start operations.

- Foreign Investment Approval (If Applicable): For ventures with FDI, ensure compliance with India’s FDI policy—currently up to 74% under the automatic route. Additional conditions apply above 49%, like Indian-majority board. IRDAI won’t issue final registration without verifying legal and regulatory adherence to FDI rules and governance norms.

- Other Ancillary Approvals: Additional approvals may be required based on your model, such as branch office permissions, foreign reinsurance branch approvals or intermediary name approvals. While secondary, these are crucial checkpoints. Ensure all IRDAI-specific licenses, clearances and post-licensing permissions are properly addressed during setup.

REQUIRED LICENSES

Apart from the preliminary approvals, specific licenses are required to legally operate in the insurance industry. The exact license depends on the type of business you are undertaking (insurer vs intermediary). Below is a breakdown of the required licenses in brief:

- IRDAI Certificate of Registration (Insurance Company License): This license authorizes companies to underwrite life, general or health insurance policies in India. Granted under Section 3 of the Insurance Act, it follows R2 approval. It’s valid indefinitely but requires the company to commence operations within 12 months and maintain ongoing compliance.

- Insurance Broker License: Required to act as a broker between clients and insurers, this IRDAI license allows solicitation of policies from multiple insurers. Categories include Direct, Reinsurance and Composite Brokers. Entities must meet capital, net worth, infrastructure and personnel qualifications. The license is valid for three years and renewable.

- Corporate Agent License: This license permits a business to distribute insurance policies on behalf of up to three insurers per category (life, general, health). Requirements are less stringent than for brokers, with minimal capital and trained staff. Common among banks and platforms offering limited insurer tie-ups. Must follow IRDAI conduct rules.

- Insurance Web Aggregator License: This license is for companies running online platforms that compare and sell insurance policies digitally. Requires a company structure, net worth of ₹25 lakh, a compliant IT setup and IRDAI approval. Web aggregators must operate fairly, protect data and provide unbiased comparisons without promoting specific insurers unjustly.

- Third-Party Administrator (TPA) Registration: TPAs handle insurance claim processing and services for insurers, especially in health insurance. Must be a dedicated company with ₹1 crore share capital, medical and administrative experts and secure infrastructure. IRDAI grants registration after evaluating operational readiness. TPAs serve as intermediaries between policyholders and insurers for claims.

- Other Specialist Licenses: Specialized licenses include Surveyors and Loss Assessors (for claim assessment) and Insurance Marketing Firms (IMFs) that offer multi-insurer policies and financial products. Each role has specific eligibility criteria and must be registered with IRDAI. Engaging in any insurance-related activity without the proper license is strictly prohibited.

WHY APPROVALS AND LICENSES ARE NEEDED

You might wonder why so many approvals and licenses are necessary. The simple answer is that insurance is a business that directly handles the public’s money and trust, so it is governed by strict laws to safeguard policyholders. Here are a few key reasons approvals and licenses are indispensable:

- Protecting Consumers: Insurance licensing ensures only credible, financially sound entities enter the market. IRDAI verifies promoters’ backgrounds, capital and business plans. An IRDAI license gives consumers confidence that the insurer is legitimate, regulated and capable of honouring its commitments, protecting against fraud and unreliable operators.

- Financial Security and Solvency: Licensing enforces capital requirements (₹100 crore for insurers) and solvency margins (150%) to ensure insurers can pay claims even in crises. These safeguards prevent undercapitalized players from collapsing and harming policyholders, ensuring long-term financial stability and claim reliability in the insurance ecosystem.

- Orderly Growth of the Industry: Licensing helps promote inclusive growth and market fairness. IRDAI mandates rural outreach plans, regulates intermediary tie-ups and commissions and ensures insurers contribute to national goals—not just urban profits. This structured oversight prevents market abuse and supports balanced, equitable industry development.

- Legal Compliance and Risk Management: Operating without an IRDAI license is illegal under the Insurance Act, attracting fines and imprisonment. Licensing enforces good governance—requiring board structure, audits and compliance systems—reducing risks of failure or mismanagement. Following these steps builds a trustworthy, law-abiding and sustainable insurance business.

HOW LAWFNITY CAN HELP YOU ESTABLISH YOUR INSURANCE BUSINESS

Embarking on the journey to start an insurance business can feel overwhelming – but you don’t have to do it alone. Lawfinity specializes in helping entrepreneurs and companies navigate the legal and regulatory maze of setting up businesses in India, including in the insurance sector. Our team of experts can assist you every step of the way, making the process smoother and ensuring full compliance with all requirements:

- Business Incorporation & Structuring: Lawfinity helps you choose the ideal business structure (public company, LLP, etc.), secures IRDAI/MCA name approvals, drafts insurance-specific MOA/AOA and completes company registration. We ensure compliance with IRDAI norms, including shareholding, FDI caps and director requirements from the very beginning of your venture.

- Regulatory Approvals & Documentation: We handle end-to-end IRDAI approval processes, from preparing Form R1 and R2 applications to compiling financials, business plans and affidavits. Our team liaises with IRDAI, responds to queries and manages deadlines—ensuring your application is complete, compliant and aligned with regulatory expectations at every stage.

- Licensing & Post-License Support: Lawfinity guides you through obtaining IRDAI licenses for insurers or intermediaries, ensuring tailored, accurate submissions. Post-licensing, we assist with product filings, compliance manuals, staff training and ongoing regulatory updates—keeping your insurance business compliant, future-ready and aligned with changing IRDAI policies.

Lawfinity can be your trusted legal hand in establishing your desired insurance business. We take pride in making the complicated process easy to understand for our clients – explaining the rationale behind each requirement (so you are not just filing papers blindly) and providing human-centric guidance with a friendly approach. By engaging Lawfinity, you free yourself to focus on the bigger strategic aspects – like developing your insurance products or distribution network – while we handle the heavy lifting of approvals, paperwork and compliance. Our goal is the same as yours: to see your insurance venture successfully launched and thriving, with full peace of mind that everything is done “by the book.”

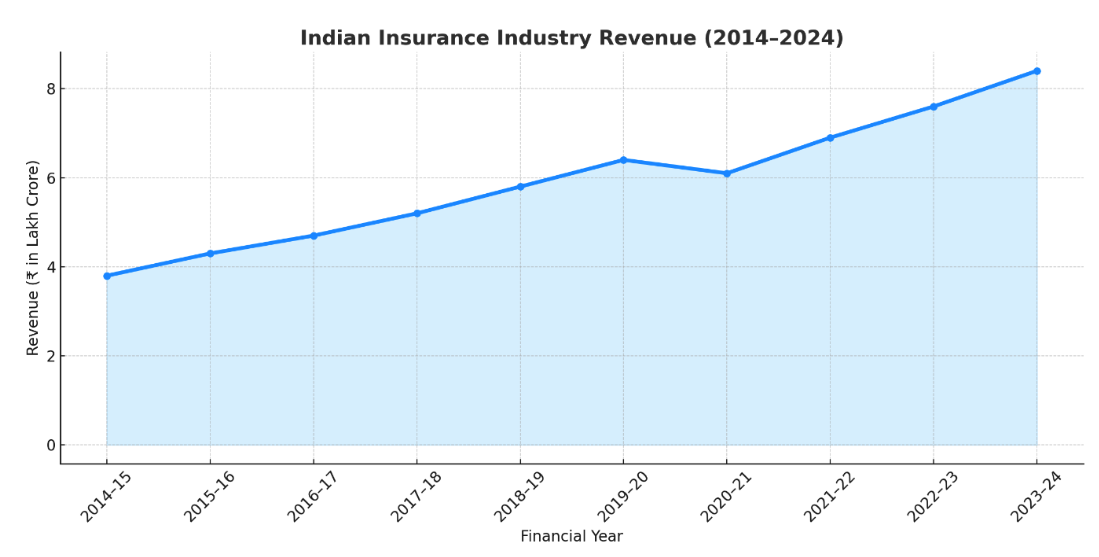

INDIAN INSURANCE INDUSTRY REVENUE (2014–2024)

Source: IRDAI Annual Reports (2015–2023), FICCI–EY India Insurance Reports (2017–2024), KPMG in India Insurance Sector Analysis and Statista & RBI Insurance Data

This line graph captures the revenue growth of the Indian Insurance Industry over the last decade, combining life insurance and general (non-life) insurance premium collections.

In FY 2014–15, the total industry revenue stood at ₹3.8 lakh crore. Over the next five years, it grew consistently, reaching ₹6.4 lakh crore by FY 2019–20. This was largely fuelled by:

- Increasing awareness of life insurance products

- Government schemes like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Ayushman Bharat

- Rising demand for health and motor insurance

However, the pandemic year FY 2020–21 caused a temporary dip in revenues to ₹6.1 lakh crore, due to reduced economic activity and falling sales in segments like motor and travel insurance.

Post-COVID, the industry rebounded strongly, reaching ₹8.4 lakh crore in FY 2023–24, led by a surge in health insurance, term policies and digitized policy distribution. The future of Indian insurance appears increasingly digital, data-driven and health-centric.

AUTHOR’S OPINION: COVER TO CONFIDENCE – INDIA’S RISK ECONOMY MATURES

The Past: Awareness Era (2014–2020)

Between FY 2014–15 and FY 2019–20, India’s insurance industry underwent a structural shift from push-based selling to awareness-led buying.

Government initiatives like PMJJBY and Pradhan Mantri Suraksha Bima Yojana (PMSBY) created insurance awareness among the unbanked. Meanwhile, private insurers focused on expanding reach beyond metros. The sector grew from ₹3.8 lakh crore to ₹6.4 lakh crore in this phase — a CAGR of nearly 10%.

Life insurance remained dominant, but non-life products (especially motor insurance) began gaining traction, especially in urban India.

The Present: Pandemic, Panic & Policy Realignment

FY 2020–21 brought an unusual twist. While the demand for health insurance surged due to COVID-19, segments like motor and travel insurance declined drastically. The result was a net dip to ₹6.1 lakh crore.

However, this period also marked the digitization revolution in insurance:

- InsurTech startups introduced online KYC and instant policy issuance.

- WhatsApp bots, AI-driven underwriting and app-based claims became mainstream.

- Health-focused covers (COVID, critical illness) and micro-insurance grew.

By FY 2023–24, revenues had grown to ₹8.4 lakh crore. The sector regained momentum, now anchored in health security, digital access and tailored offerings.

The Future: Embedded, Empowered & AI-led (2024–2030)

India’s insurance market is projected to reach ₹13–15 lakh crore by FY 2030, driven by:

- AI and IoT-based underwriting

- Embedded insurance via platforms (e.g., ticket bookings, e-commerce)

- Expansion into rural Bharat through mobile-first offerings

- Regulatory shifts via IRDAI’s Bima Trinity for universal insurance

The future will see hyper-personalized, low-cost, bundled insurance embedded into everything from EVs to UPI transactions. Health-tech and climate-insurance will dominate new product lines.

CONCLUSION: INDIA'S RISK CULTURE IS TURNING INTO A RISK ECONOMY

From my perspective, the Indian insurance industry has graduated from being reactive to being proactive.

The graph shows that insurance is no longer seen as a “tax-saving instrument” but as a financial backbone for Indian households and businesses. Be it health crises, climate uncertainty or life protection — insurance is now mainstream.

India’s real economic confidence lies not just in GDP, but in how well its people are protected. The rising arc from ₹3.8 to ₹8.4 lakh crore reflects a maturing risk culture that’s gearing up to meet tomorrow’s uncertainties — with data, digital and trust.

Frequently Asked Questions

Because every great business starts with the right answers.

To start a life, general or health insurance company in India, the minimum paid-up capital required is ₹100 crore. For reinsurance companies, the requirement is ₹200 crore. This capital ensures financial strength to underwrite policies, absorb early-stage losses and maintain solvency as per IRDAI norms.

Yes, registration with the Insurance Regulatory and Development Authority of India (IRDAI) is mandatory for all insurance-related businesses, whether you are starting an insurance company or working as an intermediary like a broker or corporate agent. Conducting insurance business without IRDAI registration is a criminal offence under Indian law and can lead to heavy penalties, including imprisonment.

Yes, foreign direct investment (FDI) is permitted in Indian insurance companies up to 74% under the automatic route. However, if foreign shareholding exceeds 49%, certain conditions apply—such as the majority of directors and key management personnel being Indian residents. All FDI must comply with IRDAI and FEMA regulations.

No. You can enter the insurance sector as an intermediary—such as an insurance broker, corporate agent or web aggregator. These models involve significantly lower capital requirements, simpler regulatory processes and quicker licensing. Many entrepreneurs start as intermediaries and later expand into full-fledged insurers once they gain experience and funding.

For insurance companies, the licensing process typically takes between 8 to 12 months or more, depending on the completeness of the application and regulatory scrutiny. For intermediaries such as brokers or agents, licenses are generally issued within 2 to 4 months. Delays may occur if documentation or compliance is lacking.

An insurance agent represents one insurer (or a limited number) and sells policies on their behalf. In contrast, a broker represents the customer and can offer policies from multiple insurers. Brokers require higher qualifications, carry fiduciary duties towards clients and are subject to more stringent IRDAI regulations.

Licenses for insurance companies are perpetual, provided they maintain regulatory compliance. However, licenses for intermediaries such as insurance brokers, corporate agents and web aggregators are typically valid for three years and must be renewed periodically with IRDAI, subject to compliance and performance review.

No, under current IRDAI regulations, life insurance and general insurance businesses must operate through separate companies and licenses. A proposed reform to introduce a composite license regime is under discussion, but until officially notified, companies must choose one line of business per entity.

Operating any insurance business without IRDAI registration is illegal and a punishable offence under the Insurance Act. Offenders may face heavy fines, imprisonment and permanent disqualification from future licensing. Moreover, any policies issued without a valid license are considered void, leading to serious reputational and legal risks.