Start Your Journey

INFORMATION & TECHNOLOGY INDUSTRY — Incorporation, Approvals & Licences

Use this end-to-end legal and regulatory roadmap for launching an IT venture in India.

INTRODUCTION

India’s Information and Technology (IT) industry stands as a global leader, significantly driving GDP growth, employment generation, and innovation. As digital transformation sweeps across sectors—cloud computing, artificial intelligence (AI), fintech, SaaS, cybersecurity, and healthtech—the demand for advanced IT solutions continues to surge. Government initiatives like Startup India, Digital India, and relaxed FDI policies have created a thriving ecosystem for both homegrown startups and global tech giants. However, before launching an IT venture—whether in software development, consulting, SaaS, or tech support—it’s essential to navigate a complex regulatory environment.

Choosing the right business structure (like Private Limited Company or LLP) is the foundation, followed by registrations such as GST, Startup India recognition, and necessary local licenses. Additionally, complying with data protection laws (such as the IT Act, 2000, and 2021 Rules) is critical, especially for ventures dealing with sensitive or financial information. Intellectual property protection (like software copyrights or trademarks), cybersecurity norms, taxation, and proper corporate governance enhance long-term sustainability. A well-structured and compliant IT business not only avoids legal risks but also builds client trust, attracts investors, and becomes eligible for government incentives and funding. In today’s competitive landscape, legal readiness is as important as technological innovation for IT success.

TYPE OF BUSINESS SUITABLE FOR THE INFORMATION & TECHNOLOGY INDUSTRY

Choosing the correct legal structure for your IT venture shapes your liability, tax treatment, funding options, and compliance burden. Here are the main options:

- Private Limited Company: A Private Limited Company under the Companies Act 2013 is typically the most suitable structure for IT startups. It provides limited liability, is investor-friendly, and is eligible for DPIIT recognition, government tenders, and grants. Most Indian tech firms and software export houses are registered as Private Limited Companies to facilitate equity investment and scalability.

- Limited Liability Partnership: An LLP offers flexibility and lower compliance than a company, while still providing liability protection. This is often preferred by service-driven IT consultancies or small teams of professionals. However, it may be less attractive for venture capital funding.

- One Person Company (OPC): OPCs are ideal for individual founders who want limited liability without partners. They offer company-level structure with fewer compliances, though OPCs cannot raise equity easily. Suitable for tech consultants or solo SaaS developers.

- Sole Proprietorship / Partnership Firm: Less formal and easier to set up, these structures are acceptable for low-scale operations. However, they expose owners to unlimited liability, can’t issue shares, and may lack credibility with larger clients or investors.

Which structure is best suited? For most IT ventures aiming to scale or attract funding, a Private Limited Company is the ideal structure due to its ability to raise equity, limited liability protection, and strong credibility with investors and clients. It suits startups planning to grow, seek venture capital, or work with large enterprises. However, for smaller or professional service-based IT businesses with no funding needs, a Limited Liability Partnership (LLP) or One Person Company (OPC) can be more practical—offering lower compliance burdens and adequate legal protection. LLPs suit partnerships, while OPCs are ideal for solo tech entrepreneurs or freelancers starting out.

NECESSARY APPROVALS

Starting an IT business involves obtaining several key approvals and clearances from different authorities. Below, we outline the essential approvals typically required:

- Entity Registration (Incorporation): Register your company as a Private Limited, LLP, or OPC with the Ministry of Corporate Affairs. This includes obtaining a name, DIN for directors, DSCs, MOA/AOA or LLP agreement, and Certificate of Incorporation. It legally enables you to enter contracts and open bank accounts.

- DPIIT Startup Recognition (optional): If eligible, you can apply online to DPIIT for official startup recognition. This unlocks benefits like tax exemption, angel-tax relief, and IP fast-tracking.

- Import–Export Code (IEC): For IT businesses that export software or IT services, an IEC from DGFT is required. It enables customs clearance, export incentives, and easy international transactions.

- Software Service Export Gateways (if needed): If you provide IT-enabled services overseas, you may need registrations under STPI (Software Technology Parks of India) or DI. This helps you avail tax benefits and incentives under relevant schemes.

REQUIRED LICENSES

In addition to approvals, you will need to obtain certain licenses and registrations to legally operate your IT business. Think of approvals as project-specific clearances and licenses as regulatory permissions or registrations that enable ongoing business operations. Below is a breakdown of key licenses/registrations required:

- GST Registration: IT businesses must register for GST if turnover exceeds ₹40 lakh (₹20 lakh for services in some states). Exported IT services are typically zero-rated, allowing businesses to claim input tax credit. This boosts liquidity and ensures compliance when dealing with interstate clients or large enterprise contracts.

- Shop & Establishment License: This license is mandatory if your IT company operates from a physical office. It regulates workplace conditions like employee hours, holidays, and wages. Issued by state governments, it ensures legal recognition of your business premises and compliance with local labour laws for day-to-day operations.

- Professional Tax and PF/ESI Registrations: If you employ staff, registration under Professional Tax (state-specific), Provident Fund (PF), and Employee State Insurance (ESI) is mandatory. PF is required for establishments with 20+ employees, while ESI applies from 10+ employees. These registrations protect employees' welfare and ensure employer compliance with labour laws.

- Data Compliance under IT Act and Rules: IT businesses that collect or process user data must comply with the IT Act, 2000, and the 2021 IT Rules. This includes appointing grievance officers, securing user consent, and protecting sensitive information. Non-compliance can attract legal penalties, especially under intermediary and cybersecurity regulations.

- MSME/Udyam Registration (Optional): While optional, registering as an MSME under Udyam offers multiple benefits such as tax rebates, easier access to bank loans, government tenders, and subsidies. It boosts your eligibility for various schemes and builds credibility, especially for small or mid-sized IT startups and service providers.

WHY SUCH APPROVALS AND LICENSES ARE NEEDED

IT businesses operate in a regulated environment, and these approvals/licenses serve multiple vital purposes:

- Legal recognition and credibility: Registering your IT business under the Ministry of Corporate Affairs (MCA) provides it with a separate legal identity. This makes contracts and agreements enforceable by law, instills trust among clients and investors, and enhances credibility with financial institutions, enabling easier fundraising, loan approvals, and vendor partnerships.

- Tax and trade compliance: GST registration and Import Export Code (IEC) are essential for smooth business operations. These allow you to collect taxes legally, claim input tax credits, and engage in cross-border trade. Non-compliance may lead to penalties and restrict your ability to work with clients in other states or countries.

- Employee welfare and statutory compliance: If you hire staff, employee-centric registrations like Provident Fund (PF), Employee State Insurance (ESI), and labour licences become mandatory. These ensure your company complies with labour laws, secures employee rights, and protects against legal action or penalties for non-compliance with workplace regulations.

- Data and digital trust: Compliance with the Information Technology Act, 2000 and IT Rules, 2021 ensures your IT venture responsibly handles user data. Meeting cybersecurity norms and appointing grievance officers builds user trust, safeguards privacy, and protects the company from liability related to digital content, cybercrimes, or data breaches.

- Access to government benefits: Registering under DPIIT (for startups), Software Technology Parks of India (STPI), or MSME/Udyam can unlock benefits like tax holidays, easier regulatory filings, priority sector lending, and eligibility for government tenders. These recognitions provide both financial relief and increased growth opportunities for emerging IT businesses.

HOW LAWFINTIY CAN HELP YOU IN ESTABLISHING YOUR DESIRED BUSINESS

Setting up a business in the IT sector can feel overwhelming, especially when dealing with the myriads of legal requirements. This is where a professional firm like Lawfinity becomes invaluable. Lawfinity is a full-service business consulting firm that offers end-to-end legal and compliance solutions for entrepreneurs in India. Here’s how Lawfinity can help turn your renewable energy business idea into reality:

- Choosing the right structure and incorporation: Lawfinity assists in identifying the most suitable business structure—whether it’s a Private Limited Company, LLP, or OPC—based on your funding goals, liability concerns, and scalability. We handle every step of incorporation, from obtaining Digital Signatures (DSC) and Director Identification Numbers (DIN) to drafting MOA/AOA or LLP agreements and filing with MCA for registration.

- Registering for mandatory registrations: We ensure your IT business starts on the right foot by promptly obtaining all essential registrations—like GST, Import Export Code (IEC), Professional Tax, and Udyam/MSME. Lawfinity’s experts streamline paperwork, resolve queries, and make sure you’re fully compliant from day one, avoiding operational delays or government notices.

- Data law compliance advisory: With rising focus on digital privacy and intermediary liability, Lawfinity guides you in complying with the IT Act, 2000 and Rules 2021. We assist in drafting legally sound privacy policies, setting up a grievance redressal system, and advising on real-time content moderation (RTC)—helping your platform stay legally secure and earn user trust.

- DPIIT/startup onboarding support: Lawfinity helps you apply for DPIIT Startup India recognition by preparing your pitch deck, business model write-up, and online filings. Once approved, you unlock benefits like 3-year tax exemption, easier IPR filings, faster bank funding, and government procurement access. We also guide you in maintaining eligibility post-approval.

- Statutory compliance management: Our team ensures long-term legal hygiene by managing monthly GST filings, MCA annual returns, PF/ESI submissions, and timely reminders for statutory deadlines. Lawfinity’s compliance support allows you to focus on scaling your IT venture without worrying about penalties, missing filings, or managing backend legal obligations on your own.

Lawfinity is your one-stop partner for starting, managing and growing a IT business. From incorporation to final licenses and daily compliance, they handle the legalities so you can focus on your core mission. With expert support, you save time, avoid costly errors and confidently build a fully compliant IT venture in India

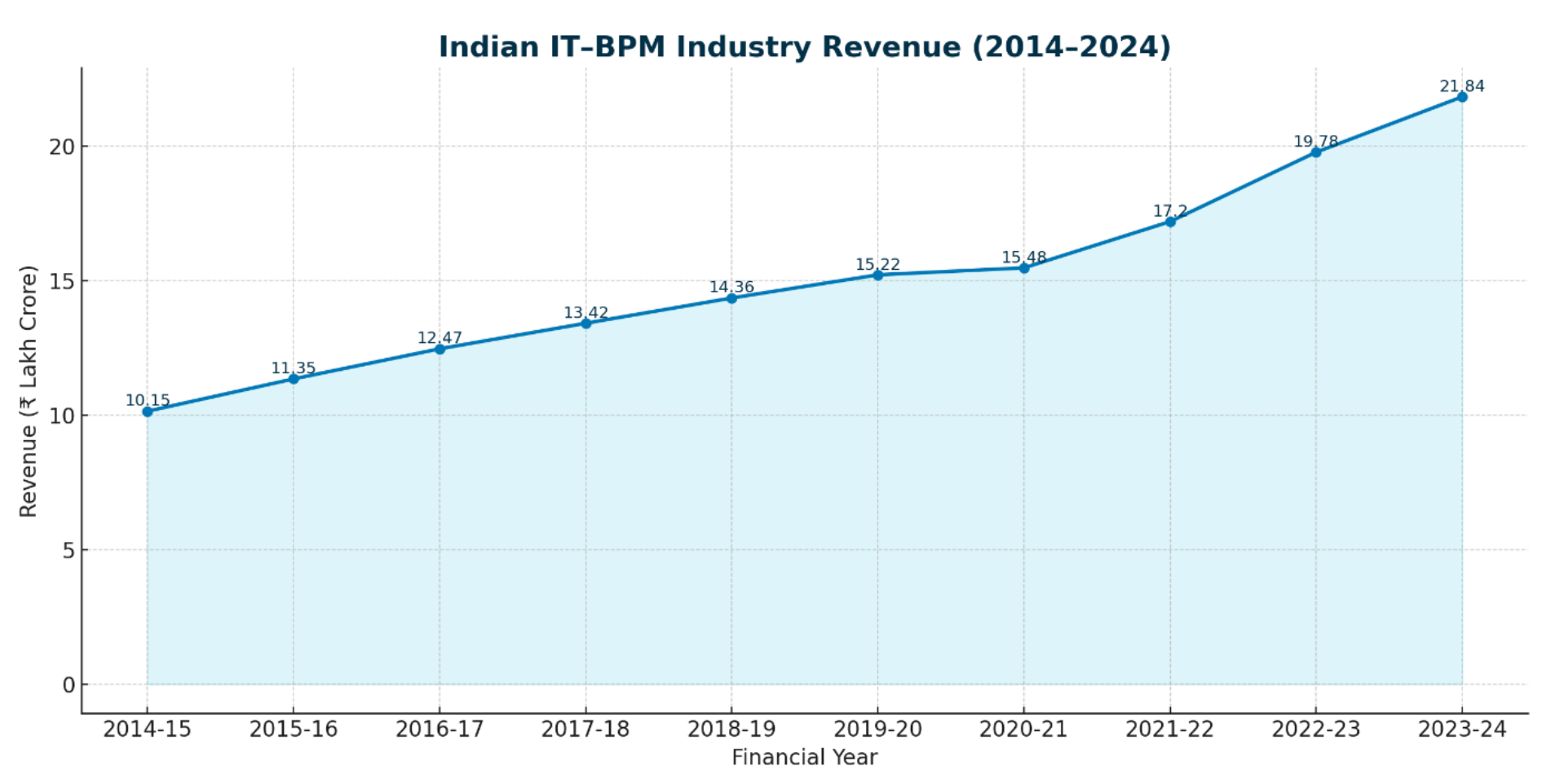

INDIA’S INFORMATION & TECHNOLOGY INDUSTRY REVENUE (2014–2024)

Source: Source: NASSCOM – Strategic Review reports & press releases; IBEF – IT & BPM sector; MeitY Annual Reports; Economic Survey 2024–25

This line graph shows the growth of India’s IT–BPM sector over the last decade.

- In FY 2014–15, the sector generated about $118 billion (~₹10.15 lakh crore), driven by global outsourcing demand, cost competitiveness, and a skilled English-speaking workforce.

- Between 2014–15 and 2018–19, revenue climbed steadily past $167 billion, aided by the rise of Global Capability Centers (GCCs) and digital transformation projects worldwide.

- The pandemic year 2020–21 brought only a mild slowdown as the industry pivoted rapidly to remote delivery models.

- By 2023–24, revenue reached $254 billion (~₹21.84 lakh crore) — with exports (~$200 billion) as the mainstay and domestic demand (~$54 billion) growing rapidly.

AUTHOR’S OPINION: A DECADE OF DIGITAL LEADERSHIP, RESILIENCE, AND REINVENTION

The Past: Building the Global Technology Backbone (2014–2020)

A decade ago, India’s IT–BPM industry was already the world’s outsourcing leader, supplying cost-effective, high-quality IT and business process services to global enterprises. Between FY 2014–15 and FY 2018–19, the industry evolved from being purely cost-arbitrage-driven to delivering complex, high-value projects.

- GCC expansion: Global firms set up R&D and engineering centers in India.

- SaaS beginnings: Indian SaaS startups like Zoho and Freshworks gained international traction.

- Digital shift: IT giants re-skilled their workforce for analytics, AI, and cloud technologies.

However, the period also brought challenges: intense competition, talent attrition, and the need for large-scale digital transformation. FY 2019–20’s slower growth reflected global uncertainty, yet the industry remained a steady GDP contributor.

The Present: Pandemic-Resilient and Innovation-Driven (2020–2024)

The COVID-19 pandemic could have derailed operations, but the IT–BPM industry’s rapid pivot to 100% remote delivery models became a global case study in resilience.

- Cloud-first acceleration: Enterprises fast-tracked migration to cloud platforms.

- Cybersecurity surge: Demand for security and compliance solutions rose sharply.

- AI & automation adoption: Intelligent process automation became a standard offering.

- Domestic IT growth: Government digital initiatives and fintech expansion boosted local consumption.

By FY 2023–24, the industry hit ₹21.84 lakh crore, with exports contributing ~80% of revenue and domestic demand contributing ~20%. The sector’s adaptability cemented India’s role as the global digital services capital.

The Future: From Services Hub to Global Tech Creator

By 2030, the IT–BPM industry is expected to exceed ₹30–32 lakh crore ($350–375 billion), shifting from being primarily a services provider to a creator of global technology products, platforms, and IP.

- AI and GenAI integration across sectors

- Deeptech R&D exports from India-based GCCs

- Policy push for semiconductor & electronics manufacturing

- Global SaaS leadership from Indian product companies

- Tier-II/III city tech hubs tapping new talent pools

However, the path ahead demands continuous upskilling, cybersecurity leadership, and strategic IP creation instead of only delivering services.

CONCLUSION: INDIA’S DIGITAL POWERHOUSE — READY FOR THE NEXT DECADE

Over the past decade, the Indian IT–BPM industry has transformed from a cost-efficient outsourcing base into a global innovation and delivery powerhouse. The journey from ₹10.15 lakh crore in FY 2014–15 to ₹21.84 lakh crore in FY 2023–24 reflects not just scale, but strategic reinvention.

Today, India’s IT–BPM firms are partners in transformation — designing, building, and managing mission-critical digital systems for the world’s largest enterprises. The sector’s strengths — talent scale, adaptability, and trust — will define its next growth phase.

The future is not just about delivering projects; it’s about owning products, shaping platforms, and leading the AI revolution. With the right mix of innovation, IP creation, and policy support, India’s IT–BPM industry is poised to lead the global digital economy — not just serve it.

Frequently Asked Questions

Because every great business starts with the right answers.

Yes. While you don’t need sectoral approvals, you must register your entity (Pvt Ltd/LLP/OPC) and obtain GST, DSC/DIN filings.

No, but it provides benefits like tax exemption, angel tax relief, and IP fast-tracking for eligible IT startups.

Yes, unless you package payments as royalty under specific models. IEC is mandatory for export documentation and incentives.

If you operate a platform or intermediary, you must follow IT Rules 2021—including grievance mechanism, user data policies, and content takedown protocols.

Incorporation usually takes 1–2 weeks. GST, IEC, and registrations can be completed in another 2–3 weeks with proper documentation.

No—typical IT companies are low-risk and exempt. However, startups in hardware or manufacturing (e.g. electronics) may need clearances.

You may face GST penalties, inability to export legally, and clients may withhold payments without proper invoices.

Yes, foreign and domestic funding is easier with Private Limited Company structure and DPIIT status, and proper filings (FC-GPR under FEMA).

Yes, some sectors may need to store certain categories of data locally under evolving norms. Lawfinity provides guidance on compliance as laws evolve.